March 2023 Participating Funds/Enterprises

Join a select group of institutional and sophisticated investors to learn about leading Australian and international investment opportunities.

ImpactConnect 1:1 in March 2023 includes the below participating funds/enterprises:

1. Dragonfly Impact Growth Fund

The Impact Growth Fund was established in 2022 and is open to investors. It is a wholesale private equity fund that invests in companies for growth, that simply by being in business, will:

![]()

The Fund is suitable for investors who:

- Want to invest in risk-adjusted, impactful, high-growth companies, that are intrinsically of purpose and generate commercial returns without concession.

- Seek an alternative investment class and diversity.

- Have a long-term investment horizon.

- Are classified as a wholesale investor.

Click here for further details

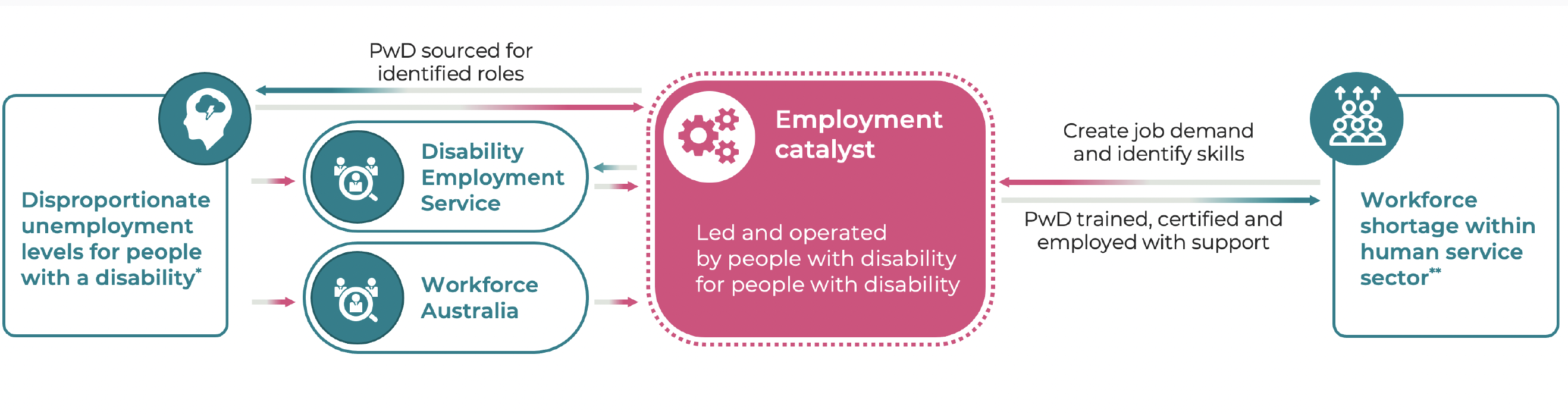

2. The Employment Catalyst by The Achieve Foundation

The offer/deal available

The Achieve Foundation is inviting investment partners for The Employment Catalyst that seeks to address two challenges – sustainable employment for people with disability and workforce shortage in the human services sector.

3 key reasons investors would find it attractive to invest with you

- This investment opportunity delivers authentic measurable benefits of employment for people with disability while presenting a scalable solution on workforce shortage in the human services sector

- In addition to social benefits of employment, this investment will demonstrate how a for purpose organisation can become financially sustainable by partnering with the government in solving their priorities.

- This investment creates an opportunity for people with disability to benefit from the multi-billion dollar disability services industry (NDIS funded) as leaders, managers, and frontline workers

Specific investment and benefits

The Achieve Foundation is seeking start-up capital of $5mn (blended finance of philanthropic grant + debt capital) to fund the trial phase which will potentially deliver employment outcomes for 2,000 people with disability.

For the year ending December 2022, the National Disability Insurance Scheme spent $31 B (annual) in funding services to nearly 570,000 people with disability through 8,753 service providers. The 20 largest service providers collectively employ ~38,000 people. Increased employment of people with disability by disability service providers is likely to be a recommendation of the Disability Royal Commission

This investment opportunity is suitable for investors:

- Who are committed to solving complex problems surrounding unemployment.

- Who are willing to offer blended finance i.e. a philanthropic grant to enable the ‘Test, Try and Learn’ phase followed by debt capital for the scale-up phase.

- Who have a conviction that people with disability should benefit from the multi-billion dollar services industry as leaders, managers, and frontline workers

- Who are passionate about partnering with a for-purpose intermediary that is building the ecosystem for impact investing in disability

Click here for further details

3. HOPE Housing

A new kind of ownership partnership

The offer/deal available

HOPE gives investors the opportunity to co-invest in home ownership alongside essential workers, enabling them to own and live in the communities they serve, with both parties sharing equally in the capital growth of property ownership over time.

3 key reasons investors would find it attractive to invest with you

- Target net return of 10% p.a. + 30c social dividend for every $1 invested: impact return quantified by UNSW Centre for Social Impact and continuously measured.

- Amplify the impact reach of your investment: a healthy and productive essential workforce is critical for Sydney’s 5 million residents, especially children, homeless and the elderly. A lack of affordable housing is escalating frontline worker churn, putting lives at risk.

- A solution to housing affordability now, not in the future: A lack of greenfield land in urban areas with high frontline worker attrition means accessing existing supply through co-ownership is key.

Specific investment and benefits

- Low management fees of 0.5%

- Access to a pool of high-quality, vetted residential assets, providing diversification benefits to a portfolio of stocks, bonds and other non-residential real-assets

- Additional incentives in place for Fund 1 foundation investors, enhancing return >10%

HOPE co-invests with essential workers in their property, significantly reducing the cost of funding for them. Together, HOPE and the essential workers share the investment and the profits. It creates affordability for them and profitability for all of us. While HOPE is a not-for-profit enterprise, it’s important that all our partners and investors benefit.

An attractive opportunity in residential property, targeting returns of 10% per annum net of fees and expenses, before tax*.

Delivering a social dividend estimated in excess of 30 cents for every $1* invested through:

- Reduced commute and time away from family helps to enhance physical and mental wellbeing

- Improvements to workplace productivity can reduce employee churn

- Cost of living savings

Puts our most essential workers on the home ownership ladder

Click here for further details

4. Impact Ag Partners SLM Agro Carbon Fund

The offer/deal available

Opportunity to participate in a $150m fund investing in Australian agriculture and carbon assets with returns generated from regeneratively produced agricultural commodities, carbon credits and land restoration.

The world’s population is going to grow by another 2 billion people in the coming decades. Agriculture accounts for 13% of Australia’s emissions and historically has been responsible for much of the decline in the our country’s natural capital. How do we feed the world and save the planet at the same time? By transitioning to a form of agriculture that profitably produces food and fibre while restoring nature and sequestering carbon in soil and vegetation.

3 key reasons investors would find it attractive to invest with you

- Impact Ag Partners and SLM Partners, with a combined $1 billion and 1 million acres under management, are leveraging their collective experience in profitably regenerating farmland to enable investors to participate in a domestic agro carbon fund.

- On a global scale, the Australian carbon market is considered one of the most rigorous and well regulated. New and updated carbon accounting methods are now enabling well managed and productive agricultural enterprises to be financially rewarded for land restoration.

- The key ingredient is good land management. Over the past 10 years, Impact Ag and SLM have been world leaders in trialling and scaling strategies that restore carbon and nature on the same parcel of land, rather than taking an either or approach.

Impact Ag Partners are leaders in agricultural and natural capital asset management and is launching a new Fund to make strategic investments in natural real assets and carbon.

The Fund will initially seek to raise AU$150M, with the goal of raising additional capital in future years. By progressively purchasing, optimising, developing, and managing agricultural assets, the Fund will create a profitable and positive environmental contribution, mitigating climate change at scale.

Impact Ag Partners believes agricultural investment catalyses change to address current global challenges impacting future generations. We are an experienced agricultural real asset management company who identifies value opportunities in real asset markets and delivers annual cash yields from the operations.

Impact Ag Partners manages over AUD$600M across Australia and the United States, including 500,000 acres of farm and ranch land. These assets produce annual and permanent crops, grazing livestock and verifiable natural capital outcomes such as carbon and biodiversity credits. This approach creates value through practicing regenerative agriculture as a nature-based solution.

Click here for further details

5. NorthStar Impact Australian Equities Fund

The offer/deal available

The NorthStar Impact Australian Equities Fund is a unit trust investing primarily in shares of companies listed on the Australian Stock Exchange (ASX). There is an urgent for more impact investors to become shareholders in listed companies that provide solutions to our social and environmental challenges as, with long-term supporters, these companies can achieve positive impact at scale.

3 key reasons investors would find it attractive to invest with you

- The Fund is the only Australian equities impact fund certified by the Responsible Investment Association Australasia (RIAA)

- We provide complete transparency on the Fund’s underlying portfolio companies

- Our annual impact reports are comprehensive and provide information on the social and environmental outcomes of all the portfolio companies.

Specific investment and benefits

- The minimum investment is $10,000 and the Fund is open to retail investors with daily applications and redemptions.

- With a track record in excess of 6 years, the Fund has delivered more than 6% p.a. (net of fees) , outperforming the ASX/S&P Small Ordinaries Industrials Index.

The Fund’s key areas of investment are affordable housing, education, healthcare, renewable energy, and regenerative agriculture. The Fund has a track record of impact investing in listed companies since January 2017.

For impact investors looking to add exposure to listed equities, the Fund offers a unique approach. The benefits of adding listed equities exposure to an impact portfolio include diversification and liquidity, with the Fund providing daily applications and redemptions. NorthStar Impact’s mission is to shift capital at scale to companies that can positively impact people and planet.

Kerry Series, the founder and Chief Investment Officer of NorthStar Impact, will be available to discuss the Fund and the portfolio companies. Kerry has over 30 years’ experience in the stockmarket and was a co-founder of Perennial Investment Partners, which grew to $20bn in funds under management. He completed the Impact Measurement Programme at Oxford University in 2018 and received the Individual Outstanding Achievement Award at the 2021 Impact Investment Awards.

Click here for further details

6. Wide Open Agriculture Ltd. (ASX: WOA, FRA: 2WO)

The offer/deal available

High-performing ASX growth company leveraged to regenerative agriculture and plant-based foods.

3 key reasons investors would find it attractive to invest with you

- We successfully disrupted the food industry in Western Australia – now it’s time to take this proven model global.

- Our regenerative lupin plant-based protein has a strong competitive moat with game-changing potential for growth and climate impact.

- 14 quarters of growth, 10,000 digital customers, distribution in 2,000 stores in 5 countries.

Specific investment and benefits

We’re leading the regenerative agriculture movement with a brand that makes it easy for consumers to exercise their beliefs in their weekly shop.

Founded in 2015 by Dr. Ben Cole and Anthony Maslin, Wide Open Agriculture (WOA) is Australia’s leading regenerative food and agriculture company. WOA is committed to creating value for shareholders and delivering real impact that empowers communities, regenerates ecosystems and inspires.

Regenerative Food Brand. WOA’s (current) CEO, Jay Albany launched the Company’s commercial food brand, Dirty Clean Food in 2019, to make it easy for conscious consumers to access food and beverages that advance regenerative agriculture. Dirty Clean Food offers next-day delivery in Western Australia to 10,000+ digital customers, with 1500+ retail and food service distribution outlets across Australia and Asia.

Plant-based Protein. In 2022, WOA launched a novel plant-based protein concentrate, Buntine Protein®. Buntine Protein® is a vegan-friendly protein concentrate produced from regeneratively farmed Australian Sweet Lupin, which is an ideal replacement for soy as a protein source, in the growing market for plant-based food and drinks.

Regenerative Ecosystem. WOA partners with farmers committed to a regenerative journey to rehabilitate and enhance the entire ecosystem of the land. This means our customers can buy delicious, nutritious food from healthy land that’s getting healthier. Products are chosen based on their market potential and the positive impact they deliver to farmers, their farmland and regional communities.

4 Returns. WOA is the world’s first publicly listed company adhering to Commonland Foundation’s ‘4 Returns’ framework, which is a holistic approach to landscape restoration measured by outcomes on financial, natural, social and inspirational returns.

Click here for further details

7. The Investmeant Fund

We believe that everything is interconnected. The Investmeant Fund is not an impact investment fund. It is a yield based investment in systemic evolution. Systems change requires new types of models to build bridges between the world we currently live in and the world we seek in the future. Our fund is dedicated to designing, planning and creating that bridge and also still retaining our connections to our own humanity as it is constructed.

Our fund doesn’t just want to grow its investor register it seeks to build a community. If you want to write a cheque and not engage in some way with our community, this is not the investment for you. We have made it easy to engage though, from staying in a sustainable off-grid cabin in Bali or Byron, getting a coffee or dinner in Barangaroo, buying an ice cream sundae in Newtown or going for a ride in a 1933 Rolls Royce that runs on electricity alone.

Our fund invests in a diversified pool of social businesses and direct assets to support and grow a new kind of wholistic model. Social businesses range from industry leading hospitality venues, to off grid housing, from engineering self-driving EVs to the future of financial advice.

The unique aspects of our social businesses is that each fosters empowerment and training programs for people who have fallen through the gaps in society and also prudently manages industry asset allocation to deliver a solid income stream for investors, while supporting growth.

Click here for further details

8. Green Gravity | Green Energy | Renewable Energy Storage

The offer/deal available

Green Gravity is raising A$12 million via a Series A funding round. This money, when combined with an expected $6m Australian Government grant, will fund three key milestones

- Finalisation of the “Digital Twin”. Sophisticated computer modelling providing allowing product development capability through low cost adaptation of designs to specific shaft conditions

- Completion of the Data Facility – a 12 metre high test facility to be used for system testing, data and product development

- Working demonstration in shaft – a mid-range shaft chosen from our existing MoU partners to fully demonstrate the solution on site

3 key reasons investors would find it attractive to invest with you

Green Gravity offers investors an opportunity to be part of the world’s renewable transition whilst still enjoying what we expect to be significant returns on their investment.

- Trillions of dollars are expected to be made available over coming years to fund sustainable, renewable, green alternatives to fossil fuel generated power. We offer an exciting opportunity to be part of this investment and social phenomenon

- Green Gravity has secured offtake and partner MoU deals with some of Australia’s largest miners and energy companies who also intend to invest equity into this fundraising round to accelerate the advancement of the Green Gravity solution

- Huge global market >US$600bn. Clear path to commercialisation. Vast numbers of potential customers in Australia as well as other huge markets such as the US and India

Specific investment and benefits

An attractive combination of an early stage investment combined with the comfort of joining significant funding from major players in the space in what is one of the key investment themes of this decade being decarbonisation and sustainable renewable energy

At Green Gravity, we develop and operate cutting edge gravitational energy storage systems. We aim to become the world’s lowest cost and most sustainable provider of energy storage technology.

Decarbonisation of the energy system needs rapid deployment of renewable energy. To manage the inherent variability of renewables, energy storage must be added to our electricity grids. Our technology solution utilises conventional mechanical components to enable low-cost energy storage to be installed at legacy mine sites.

Based in Wollongong Australia, we are working with global miners, energy companies and research institutes to scale up our innovative energy storage technology. During 2023 we are moving to large-scale demonstration of the technology in an operating mineshaft and are currently seeking capital to support demonstration and prepare for commercialisation.

Click here for further details

9. Urban Villager

The offer/deal available

Urban Villager is a mission-locked, triple-bottom-line, wellness housing and development company. We have a number of different investment types available across different projects, including into our shared equity, build-to-rent and partnership projects. We can work with finance-first impact investment, and also with impact-first impact investment and not-for-profit groups and landholders requiring DGR1 status. We can take direct investment as either debt or equity, and we can also take indirect investment through a licensed impact fund manager, who can do the deal due diligence on the investor’s behalf.

3 key reasons investors would find it attractive to invest with you

- True triple-bottom-line outcomes

- Asset-backed opportunities, with both direct investments, and investment through a fund available

- Scalable and replicable model: we can continue to work with capital for multiple projects (and through a fund, it’s a very simple opportunity with the fund taking care of the deal due diligence)

Specific investment and benefits

At Urban Villager, we use real estate development as an agent for social good. As both architect and developer, we’re able to see the whole of the project, and to optimise for people, the planet, and sustainable financial returns. We’re a growing team, and we’re looking to increase our network of trusted investors with the intention to continue to work with you time and time again to really tackle the housing crisis.

Urban Villager works across four main types of projects, being land subdivisions, townhouses for co-living, vertical villages and micro-apartments, and our research and development projects. We have four main types of exit, being as standard on-market sales, shared equity, build-to-rent, or as a partnership with a land partner, often in the not-for-profit space.

The best way to understand if we’re a good fit for working together is to come and have a conversation with us about who you are, what your impact goals are, and the difference you’d like to see in the world.

Click here for further details